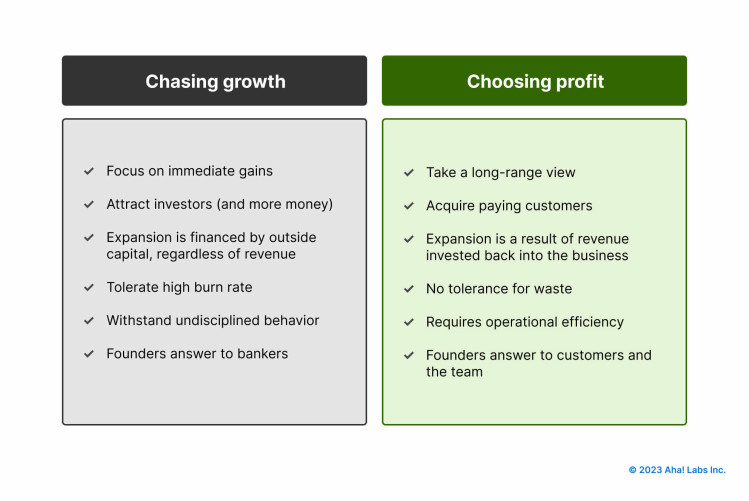

Chasing Growth vs. Choosing Profit

There is a reason that many folktales are rooted in logical fallacies. We tell these stories to remind ourselves about the chain reaction of our egos, choices, and actions. The emperor with no clothes, Jack’s beans, mocking an ugly duckling — a modern retelling of all three could easily involve growth-hungry, overfunded tech startups pitted against their bootstrapped counterparts.

Even before the recent fallout of years of superabundant capital, I could have told you how this story ends. Because I lived it before.

Silicon Valley is my home. It has been for a long time. The folklore for the last decade has been that the first thing a would-be founder should do is seek outside funding. The more, the better. (I still talk to people who think that this is the only path.) Investor cash in hand, the next thing to do is spend that money. Hiring, marketing, more, more, more — whatever it takes to get to a liquidity event. The conversation is about valuation over real value, the kind that is based on meaningful financial performance.

Growth at all costs became the status quo. Too many who lined their pockets during the years of free and easy money were happy to ignore history and keep chasing growth. It should have been aberrant, definitely abhorrent — high capital burn, extreme tactics to meet investor goals, and the panicky feeling of always being one funding round from full failure. That cannot be anyone’s idea of normal.

Does a software company really need hundreds of millions of dollars and tens of thousands of employees? Is it responsible to spend millions on advertising without any concern for what a reasonable acquisition cost should be based on the lifetime of customers? Why did we become comfortable lauding businesses mired in debt? Should every new round of funding make headlines? Did we not learn from the last time?

The idea that a company can either grow fast or be profitable is absolutist. And it is simply not true.

Yes, there are different growth trajectories for companies at different stages and in different industries. And there are incredibly competitive or oversaturated spaces that can feel winner-take-all — a race to see who can capture the most market share even if it means running at a loss. But there is another truth here.

People are unique. In most markets there is usually space for several companies who can serve customers with different offerings. And if your aim is to build something of value — for customers, the team, and your community — then you can see how choosing profit can give you more of that space for longer.

I know this from personal experience: Choosing profit does not mean forgoing growth — Aha! and many other bootstrapped companies have proved you can do both.

Our company has grown exceptionally fast over the last 10 years or so — while also being highly profitable. We blasted past $100 million in ARR at the beginning of 2022. And we did it without salespeople, without offices, and with a relatively modest team size. It was a lot of hard work from dedicated people and together we built something lasting.

Valuing freedom is a universal human trait. Last year I predicted that we will once again begin to see an emergence of more self-funded, highly profitable, and focused businesses. Now that 2023 is here I look forward to reading their stories and celebrating sustainable growth.

Aha! is 100 percent remote, profitable, and hiring now. Join us?